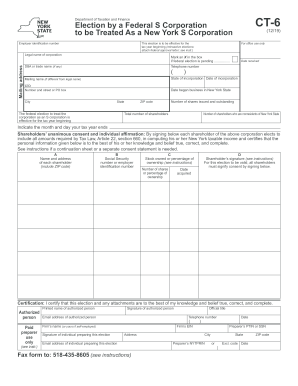

NY CT-6 2020-2024 free printable template

Get, Create, Make and Sign

How to edit ct 6 form online

NY CT-6 Form Versions

How to fill out ct 6 form 2020-2024

To fill out CT 6, follow these steps:

Video instructions and help with filling out and completing ct 6 form

Instructions and Help about ct6 form

The ct-6 traction splint is significant investment by the WAS inpatient care the domain has been a long Dorian of the service and done it'really well for the last ten years or so but as technology has improved it'important that the Mac moves with that technology the kitty ct-6 offers the following advantages its life it's smallish×39’s easy to use it can be us eon pediatric patients it actually can reuse for patients with bilateral femoral fractures which we have now to do with the Dolomites previously and most importantly it can also be applied to patients who have a pelvic splint institute it×39’s important to recognize that the application of attraction splinter femoral fractures is a very important part of hemorrhage control and analgesia, so these are priority for patients who are suffering significant trauma and have a femoral fracture we do understand that a number of our patient shave potentially acidity in pelvic fracture as well as a femoral fracture with the new CT six splints we can apply the pelvic binder firstly and then apply the CT six traction splints to our potential friend more fracture as well it's important to do ITIN that order remembering you're more likely to bleed to death from a fractured pelvis initially than you are from a femur but addressing the femoral fracture is very important because it does reducelong-term morbidity and mortality with that condition especially when apply to early, so it is a priority of care over the years paramedics have asked me what type of discipline do we use for particular fractures of the lower limit×39’s important to recognize that that six ix is not to be used for ninth femur fractures the use of a CT six is for shaft fractures of the femur not involving the knee joint for fractures of the knee joint or the tibia or ankle we use the vacuum splints that resupplied by the ambulance service a long leg vacuum splint is to be used for all fractures of the knee or the proximaltwo-thirds of the tibia / fractures involving the distal one-third of the tibia and the ankle a short leg vacuum splint with a leg placed into anatomical position is the way to go by now you will have read the lesson directive on the CT six splints I know you will have committed it to memory from here you×39;rewatching this video which will demonstrate the application of the splint see the next thing you do is with colleague is to apply a splint teach other and get to know the workings of the splint, so they can adequately perform it in an operational environment the next thing to do is to go to LMS and complete the self sign-off from therefore×39’re free to use the CT six and would bee a very important part of your patient care the CT six is a traction splint that aligns and immobilizes femoral fractures the splint reduces muscle spasms pain and helps prevent blood loss and any further damage to anatomical structures the splint comes complete in this small kit bag making it easy to store and transport the CT six uses...

Fill ny ct 6 election s : Try Risk Free

People Also Ask about ct 6 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ct 6 form 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.