NY CT-6 2020-2026 free printable template

Show details

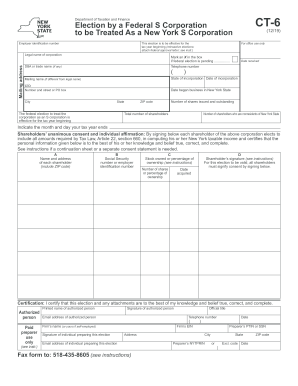

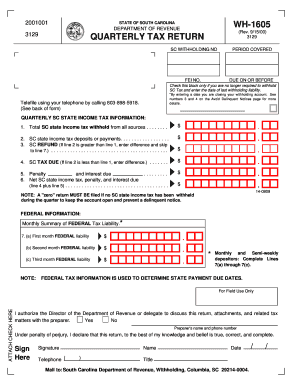

CT-6 Department of Taxation and Finance Election by a Federal S Corporation to be Treated As a New York S Corporation Employer identification number This election is to be effective for the tax year beginning Legal name of corporation For office use only retroactive elections see instr. Mark an X in the box if federal election is pending. Date received Telephone number DBA or trade name if any Mailing address 12/20 State of incorporation Date of incorporation Mailing name if different from...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny state ct 6 form

Edit your ct 6 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 6 form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ny ct 6 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CT-6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ct6

How to fill out NY CT-6

01

Obtain a copy of the NY CT-6 form from the New York State Department of Taxation and Finance website.

02

Fill in your business's legal name and address at the top of the form.

03

Enter the federal employer identification number (EIN) in the designated box.

04

Indicate the type of entity (e.g., corporation, partnership) in the appropriate section.

05

Complete the questions regarding the nature of your business activities.

06

Provide the requested financial information accurately in the designated fields.

07

Review the application for completeness and accuracy before submitting.

08

Sign and date the form where indicated.

09

Submit the completed form to the appropriate tax authority as instructed.

Who needs NY CT-6?

01

Businesses operating in New York that are seeking to claim tax benefits or exemptions.

02

Corporations or partnerships looking to apply for certain tax credits.

03

Any entity that wants to report its business activities accurately on state tax returns.

Fill

nys ct 6

: Try Risk Free

People Also Ask about ct6 form pdf

What is a CT6 form?

To officially be designated as an S corporation in New York, your business will be required to file a Form CT-6, which is the Election by a Federal S Corporation to be Treated as a New York S Corporation.

Is Cadillac replacing CT6?

Look for it to be launched in that market sometime in 2023. The new sedan looks similar in size to the current CT6, which measures 205.8 inches in length. But instead of the traditional notchback design of the CT6, the new sedan adopts a curved roof with a fastback design.

Will Cadillac make a sedan in 2023?

2023 Cadillac CT4/CT4-V/CT4-V Blackwing Changes - Find the best Cadillac deals! The CT4 and CT4-V sport sedans stand pat for 2023. The only change is the availability of three new extra-cost paint colors: Radiant Red Tintcoat, Argent Silver Metallic, and Midnight Steel Metallic.

Will there be a 2023 Cadillac CT6?

We expect the next-generation Cadillac CT6 to reach the market in the vicinity of the 2023 model year. Until then, we expect the current, first-generation CT6 to receive minor changes, updates, and improvements.

Why was the CT6 discontinued?

General Motors discontinued the assembly of the Cadillac CT6 in the US in February 2020 due to poor sales and retooling of the Detroit/Hamtramck facility for electric vehicle production, beginning with the new GMC Hummer EV.

Is Cadillac discontinuing the CT6?

The Cadillac CT6 has long since been discontinued in the United States, as production officially ended back in early 2020, with the 2020 model year being the last of the luxury sedan.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form ct 6 nys directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ct6 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute ct 6 instructions online?

pdfFiller has made it easy to fill out and sign new york form ct 6. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit nys form ct 6 on an iOS device?

Create, modify, and share ny form ct 6 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is NY CT-6?

NY CT-6 is a New York State tax form used by nonprofit organizations to apply for an exemption from the corporation franchise tax.

Who is required to file NY CT-6?

Organizations that are seeking tax-exempt status under New York State law must file NY CT-6.

How to fill out NY CT-6?

To fill out NY CT-6, organizations must provide information such as their name, address, type of organization, and details regarding their tax-exempt status and activities.

What is the purpose of NY CT-6?

The purpose of NY CT-6 is to allow qualifying nonprofit organizations to apply for exemption from New York State corporation franchise taxes.

What information must be reported on NY CT-6?

NY CT-6 requires organizations to report their legal name, address, tax-exempt status, purpose of the organization, and additional information about its operations and finances.

Fill out your NY CT-6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct 6 New York is not the form you're looking for?Search for another form here.

Keywords relevant to nys ct6

Related to ct 6 new york

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.